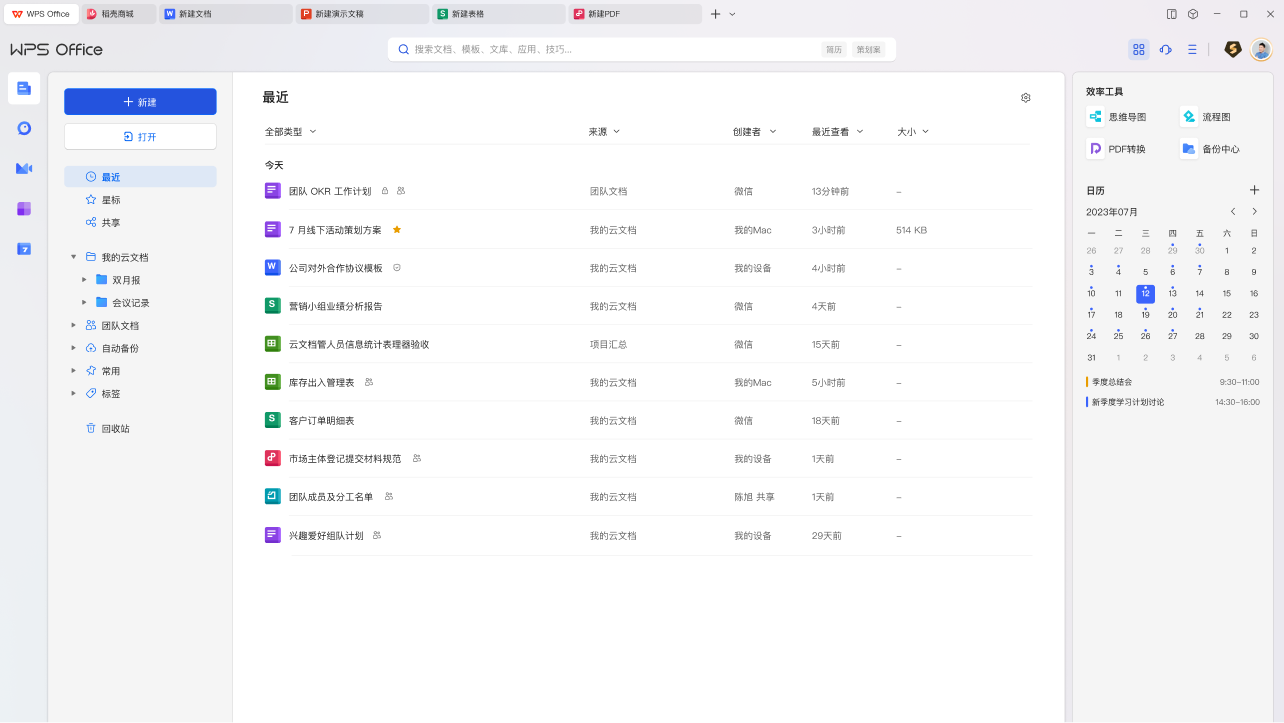

In the evolving world of funded trading, traders are progressively seeking tools and environments that nurture increase and public presentation. Leveraging the hi-tech capabilities of MetaTrader 5 and aligning with the Best Prop Firm in 2025 can help traders make a solid state instauratio for uniform come along. This article explains how operational use of weapons platform features can enhance funded trading public presentation, especially for traders preparing to bring home the bacon in a professional prop firm environment wps office.

Understanding the Role of MetaTrader 5 in Funded Trading

MetaTrader 5 is a various and right trading platform studied to subscribe various fiscal instruments and trading styles. When paired with the structure and resources offered by the Best Prop Firm in 2025, it provides a efficient for tell execution, market analysis, and risk direction. Traders gain get at to tools that help them build confidence, maintain check, and enhance -making.

Why Platform Familiarity Matters

Success with the Best Prop Firm in 2025 depends on your power to trade in with preciseness and pellucidity. Knowing how to use MetaTrader 5 in effect helps traders stay unionized, ride herd on commercialize conditions, and execute trades with confidence. Understanding tell types, charting tools, and sailing features minimizes mistakes and improves trade management.

Charting Tools and Custom Indicators in MetaTrader 5

Charts are necessity for rendition commercialise trends, and MetaTrader 5 delivers sophisticated charting options. Traders can tailor-make charts, set timeframes, and apply technical indicators that subscribe their scheme. When grooming for financial backin with the Best Prop Firm in 2025, using these tools can make terms trends clearer and help identify and exit points with better precision.

Automated Trading and Strategy Testing Capabilities

One of the standout features of MetaTrader 5 is its recursive trading and strategy testing . Traders can automate their strategies and back-test performance using historical commercialise demeanor. This boast is valuable when development a organized set about before applying it with live funded accounts through the Best Prop Firm in 2025. Automated scripts can also help tighten feeling -making and maintain rule-based discipline.

Order Execution Efficiency and Risk Tools

Speed and accuracy are world-shaking while trading funded accounts. MetaTrader 5 allows fast enjoin execution, sixfold enjoin types, and the use of stop-loss and take-profit tools. These elements are necessary for maintaining capital train while trading with the Best Prop Firm in 2025. Understanding how to use well-stacked-in risk functions ensures that traders stay aligned with safe trading principles and financial backin rules.

Analyzing Market Depth and Trends

The of commercialise boast in MetaTrader 5 helps traders sympathise liquid and terms movements. This tool is particularly useful for characteristic commercialise persuasion and potentiality jailbreak zones. When working toward valuation and scaling opportunities with the Best Prop Firm in 2025, traders gain from observant tell flow and using it to steer planning and entries.

Strengthening Trade Psychology through Platform Structure

Trading psychological science is often the difference between success and failure. The structured in MetaTrader 5 complements the rules-oriented support models of the Best Prop Firm in 2025. Traders teach how to keep emotions under verify, swear their psychoanalysis, and watch risk parameters. Consistency improves as traders build routines supernatant by platform features.

Learning Resources and Training with MetaTrader 5

There are many educational resources and guides available for MetaTrader 5, qualification it easier for traders to build technical foul knowledge. The also provides validating resources that align with platform utilisation. Combining both helps traders practise writ of execution, empathize platform tools, and rectify strategies to play off modern trading conditions.

Practicing and Enhancing Strategy Execution

The more time traders pass practicing their execution title in MetaTrader 5, the stronger their decision mechanics becomes. Simulated environments, demo trading, and scheme trials allow traders to establish confidence before handling real working capital with the Best Prop Firm in 2025. Practicing consistently leads to a trained outlook and optimizes writ of execution timing.

Achieving Consistency Through Platform Mastery

Consistency is not a coincidence; it results from function, check, and tool mastery. By sympathy every aspect of MetaTrader 5, traders can fine-tune processes, monitor markets clearly, and make wise to decisions. Combined with the social organization of the Best Prop Firm in 2025, traders put down themselves for becalm growth and long-term funded trading winner.

Final Thoughts

Excelling in funded trading is a of science, condition, and specific use of engineering. Harnessing features and orientating with the Best Prop Firm in 2025 empowers traders to do confidently and better step by step. With convergent practice, platform mastery, and homogeneous execution routines, traders can civilize warm habits and stand out in the challenging yet appreciated worldly concern of funded trading.